The ASX announcement contained a host of solid assays from the project upon which Azure has been working for just 18 months.

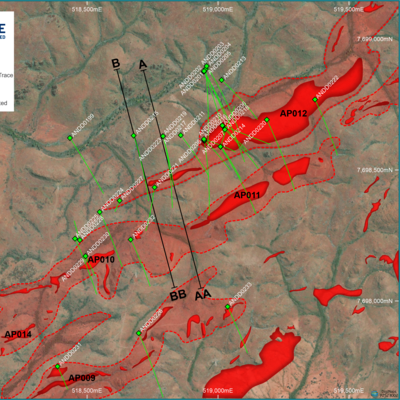

So far 33 diamond core holes have been completed for 11,150m and 66 RC holes for 12,164m. Drilling is currently testing along the more than 2000m strike extent of the corridor containing the lithium hosted in pegmatites.

Managing director Tony Rovira explains that Andover began as a nickel sulphide joint venture between Azure (60%) and the Creasy Group (40%), which is famous prospector Mark Creasy's minerals investment business.

"We entered the deal three years ago and discovered two deposits called Andover and Ridgeline, which together contain six million tonnes at 1.5% nickel equivalent. They are both very good looking deposits," said Rovira.

"But then, about a year and a half ago, while we were out exploring for nickel, we decided to look at the opportunity for pegmatites and lithium mineralisation on the same Andover project. And we found abundant outcropping pegmatites in a different part of the project area, away from the nickel deposits."

Given the hot-running and long-term outlook for lithium, Azure swiftly switched its focus from the nickel to lithium ꟷ and immediately began mapping and sampling.

A sea of red illustrates the length and breadth of lithium-bearing pegmatites at the Andover project

It was towards the end of 2022 that Azure advised the ASX that the company had discovered outcropping pegmatites which contained spodumene and had returned high grades of lithium mineralisation from just the surface sampling.

Azure was then approached by a Chilean chemical company, SQM [Sociedad Química y Minera], which is the world's biggest lithium producer and supplier of plant nutrients, iodine, lithium and industrial chemicals.

SQM wanted to take a stake in Azure, based solely on the back of just the rock chips and the mapping the company had carried out on the project area.

The result was that SQM would invest $20 million in Azure for a 19.99% stake in the company.

"We had no drill holes into the pegmatites or lithium at that stage. At the beginning of this year, we closed the deal with SQM, we received the money and began drilling in March on the pegmatites."

Rovira says that this was a huge endorsement for the potential of Andover to host a world-class lithium deposit.

Since then, Azure has had two diamond and three RC drill rigs at site and assays from this work has identified very broad zones of lithium mineralisation within the pegmatites.

"We have multiple drill intersections that are over 100m wide of high-grade lithium mineralisation. SQM is now obviously very happy with its investment and we are very happy with the discoveries we have made because Andover looks to have the potential to be one of the largest lithium deposits in Australia," Rovira said.

Rovira adds that with so many drill rigs operating at the moment, Azure has the potential to identify a very large mineral resource.

"We are continuing to step out with the drill holes. We have now identified mineralisation in three different pegmatites over 2km long and lithium mineralisation within the pegmatites are up to 100m wide. We'll be drilling these pegmatites for the next few months and it is our intention of releasing a maiden mineral resource estimate in the first quarter of next year."

Also somewhat happily, Azure already has in place a heritage protection agreement with the local traditional owners and continues to operate under that HPA, with some modifications due to the new heritage legislation which has been introduced in Western Australia.

Mining the nickel and lithium in tandem would not be possible as they would require separate processing operations. But Rovira insists the two nickel deposits defined are well understood and they have the potential to become larger.

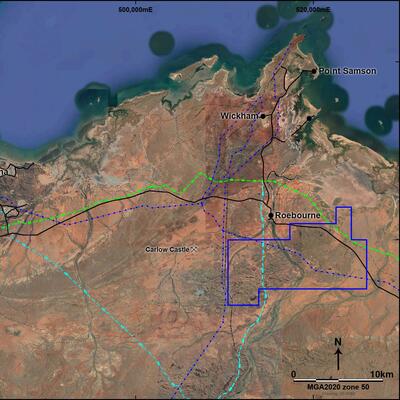

Azure's Andover lithium project finds itself in a world-class mining district with infrastructure to match

"The upside for nickel is to find new deposits, and there are several new high-priority targets which we will drill some stage in the future. But in the meantime, for now and the rest of the year we are very much focused on drilling out the lithium resources."

Rovira says that thanks to the lithium discoveries, Azure's share price has been rewarded.

"The market loves this lithium discovery, the share price has gone from 20c to $1.60 over the past six months."

As for Azure's place in the sun, Rovira could not be happier working in the Western Pilbara, where the Andover lithium deposits are just four or five kilometres from the town of Roebourne.

"That whole area between Roebourne and Karratha is heavily industrialised. There's a lot of infrastructure thanks to iron ore mining and oil and gas facilities. Andover is probably one of the best located exploration and development projects in Western Australia," said Rovira.

Rovira will be presenting at the Diggers and Dealers Forum in Kalgoorlie in early August and regards the most important takeaway from what he will say is that Andover has the sheer size potential, and Azure has the opportunity to define what potentially could be one of the largest lithium deposits in Australia.