The company celebrated its 20th anniversary last year and while it may still be a bold explorer, De Grey has moved in a quantum leap from those early days to become tantalisingly close to producer status in this decade.

The development of the Hemi gold deposit within the Pilbara gold project in Western Australia has been, over recent years, watched with delight by those in the gold mining space ꟷ and the market has rewarded De Grey accordingly for its efforts in developing this Tier One gold resource.

The Hemi mineral resource estimate update filed with the ASX in June this year was quite stunning.

Managing director Glenn Jardine explains: "The mineral resource update in June increased the overall MRE at Hemi to 9.5 million ounces, which in turn increased the global resource estimate to 11.7Moz.

"And a part of that MRE update was that we increased the measured and indicated classifications to 8.1Moz, which is quite a large percentage of the overall resource. That really goes to demonstrating a quality resource. It also aims at achieving a higher level of reserves to go into our definitive feasibility study in terms of production profile," Jardine said.

Resource drilling at Hemi and regional exploration currently comprises one aircore, two RC and three diamond rigs

The DFS is expected to be published in the September quarter 2023 and De Grey sees it as having similar physical production metrics to the PFS ꟷ but with a higher proportion of reserves in the production profile.

Jardine says that this increase percentage of reserves will help maximise the debt carrying capacity of the project when De Grey finds itself in a position to seek project funding.

"We have separately announced that we are running a financing process in parallel with the completion of the DFS. Since finishing the PFS, the feedback we received from potential debt providers was that if we could show greater than 95% in reserves during a potential loan-life period, we would be able to maximise the debt carrying capacity of the project.

"But we also want to demonstrate to the wider market that we have a degree of confidence in what we are saying about our production profile."

Jardine is happy with milestones achieved recently, one of the most important of which was the signing off on an agreement with the Kariyarra people, the traditional owners in that part of the Pilbara. In conjunction with the Kariyarra people, De Grey has also completed recent heritage surveys over the project footprint.

The next milestone came in June this year when De Grey submitted its environmental approval documentation.

Jardine regards these milestones, as very important components of working towards a winning outcome for everyone.

"We are also building on the internal organisational capability of the company to execute the development of the project, and as part of that we employed a project director in February this year, Peter Holmes.

"Peter was previously the project construction director for Barrick in Canada, responsible for some large capital projects including the Dominican Republic's Pueblo Viejo gold mine, the fifth largest in the world which incorporates a pressure oxidation circuit which will also be used at Hemi," said Jardine.

But despite this important appointment, Jardine believes that De Grey has substantial internal capability compared to a few years ago. And all of this capability is directly targeted at the company being able to execute the project.

Up until recently, the hammering of drill rigs was substantially dedicated to resource development at Hemi, but Jardine is quick to add that in terms of exploration outside of the main project, some good results have been achieved over the past 12 months.

"We tend not to put out individual results, but we have had success in what we call the Greater Hemi Area, particularly in the west at a target we have called Antwerp. We are following up Antwerp with RC drilling at the moment."

He adds that there had been success drilling beneath the proposed pits at deposits Diucon and Eagle. Additionally, there have been new discoveries made at Withnell and Towerana.

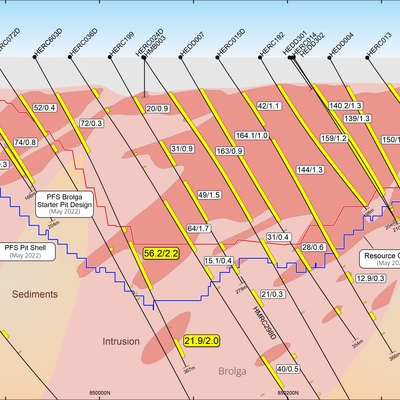

A cross-section of Brolga intersections

Follow-up RC drilling is now taking place at Withnell and Towerana, and teams will also be doing more exploration on some high-grade intersections encountered outside the pit shells at Towerana.

Charity Well is another new intrusion discovery and there are some "interesting historical intersections" at Mount Berghaus, where parallel structures have not yet felt the bite of a drill bit. These will be subject to further exploration.

He says that while there is a very solid production profile from the Hemi open pits, the company would like to start looking at what additional production could be added from the regional deposits.

But in terms of nuts and bolts, the Brolga starter pit is where De Grey plans to commence production feeding the 10Mtpa plant. The starter pit, Jardine says, represents a massive de-risking for the project and the company.

"We are very fortunate that the Brolga starter pit in the PFS contains just over 1Moz, has a very low strip ratio of 2.3:1 and a low operating cost of A$A865 per ounce. This resulted in a payback period on the project within two years.

"I can't emphasise enough how important that is for reducing the financial risk on the project."

Once the Brolga starter pit is completed in year three, it provides the opportunity to delineate underground mining blocks to augment production coming from surface.

Jardine says that De Grey is planning to take Hemi into production.

"When we have looked at the financial metrics around whatever options you can think of, the greatest value for shareholders is De Grey bringing Hemi into production. This is because of the re-rating the company will get on the back of forecast production and on multiples based on forecast EBITDA. ," Jardine said.

ABOUT THIS COMPANY

De Grey Mining

De Grey Mining Limited is a Western Australian gold explorer and project developer which has made one of Australia’s most exciting new gold discoveries at Hemi in the Pilbar.

HEAD OFFICE:

-

Ground Floor, 2 Kings Park Road, West Perth, Western Australia, 6005

- Postal address: PO Box 84, West Perth, Western Australia, 6872

- Telephone: 61 8 6117 9328

- Email: admin@degreymining.com.au

- Web: degreymining.com.au

SOCIAL MEDIA:

DIRECTORS:

-

Simon Lill (non-executive chairman)

-

Glenn Jardine (managing director)

-

Andy Beckwith (executive technical director)

-

Peter Hood (non-executive director)

-

Paul Harvey (non-executive director) Emma Scotney (non-executive director)

QUOTED SHARES ON ISSUE:

- 1.56 billion

MARKET CAPITALISATION:

- A$2.3 billion (July 25)

MAJOR SHAREHOLDERS:

- Gold Road 19.9%