Auroch has just wrapped up its maiden RC drilling programme at the recently-acquired Nepean project near Coolgardie and has already delivered "uniquely special" results.

The company added Nepean to its portfolio in the pro-mining jurisdiction in November through its deal to acquire 80%, complementing its Leinster and Saints nickel projects in the northern Goldfields.

Among the early drilling highlights at Nepean, Auroch intersected near-surface, thick, high-grade nickel mineralisation near the former mine, including 8m at 4.3% nickel and 0.37% copper from 35m.

Other results included 2m at 7.51% nickel and 0.39% copper within 8m at 3.21% nickel and 0.13% copper from 63m.

"These kinds of grades and thicknesses would be impressive drill results at any depth, but to get such thick high-grade nickel sulphides at such shallow depths is something uniquely special," managing director Aidan Platel said.

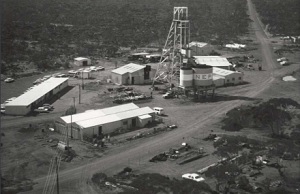

Nepean was Australia's second producing nickel mine and Auroch sees a bright future for the project.

"These recent results have exceeded all expectations, and lay a solid foundation to progress forward to assessing a potential openpit scenario at Nepean that could generate significant cash flow for the company," Platel added.

More assays are imminent, along with results from a regional aircore programme.

Meanwhile a high-powered ground moving loop electromagnetic survey is this month looking at critical target areas of the 10km of regional strike, to the north and south of the historical mine area.

"There is real potential along strike for significant high-grade nickel sulphide mineralisation," Platel said.

Exploration results will help shape the next round of drilling, set to start in May.

The prospective project also has surface gold anomalies, previously identified by Focus Minerals, and Auroch has also contracted a geologist to investigate the project's lithium potential.

Auroch Minerals is uncovering more potential at the past-producing Nepean nickel mine

In terms of nickel, Nepean has a remnant, high-grade JORC 2004-compliant resource of 13,250t of nickel, grading 2.2%.

Auroch is aiming to establish a JORC 2012-compliant resource for Nepean this year, to enhance its ability to fast-track the project into production.

More broadly, the company is aiming to deliver global resources of 100,000t of contained nickel.

At Saints, it already has 1.05 million tonnes grading 2% nickel and 0.2% copper, for 21,400t and 1,600t respectively, along with the added bonus of an existing offtake agreement with BHP.

Auroch is also aiming to establish a maiden JORC(2012)-compliant resource for its Leinster project this year.

High-grade mineralisation intersected by Auroch at Leinster's Horn prospect in late 2020 included 7.3m at 2.2% nickel and 0.53% copper from 143m, and 4.09m at 2.4% nickel and 0.61% copper from 119.91m.

Diamond drilling is now underway at Leinster and will be followed by an RC programme to test more regional targets.

"We're excited to be back on the ground at Leinster and drilling such high-potential exploration targets," Platel said.

He noted the last year's drilling results had demonstrated how well the Horn's mineralisation was mapped by the aeromagnetic anomaly there.

"We have very similar aeromagnetic anomalies along strike to the northwest of the Horn which basically have never been drilled, so we are eager to test these anomalies and see if the relationship between the aeromagnetic highs and the nickel sulphide mineralisation continues along strike," he said.

Musk-needed nickel

Tesla boss Elon Musk recently noted nickel supply was his "greatest concern", a week after the nickel price hit a seven-year high above US$19,000 per tonne in February.

Platel said the increased uptake of EVs and improving battery technology was requiring more and more nickel.

"Within the broader nickel market, the scarcity of nickel sulphide deposits is contributing to an even greater looming shortage of Class 1 nickel which can be used in batteries," he said, referring to recent estimates by McKinsey.

Auroch is moving quickly to position itself to extract the best potential from its nickel sulphide projects.

Auroch Minerals MD Aidan Platel

"We're aiming to create shareholder value with the discovery of high-quality nickel sulphide resources," Platel said.

Aside from aiming to establish maiden resources for Nepean and Leinster - and a possible upgrade for Saints - Auroch is also looking to negotiate toll treating and offtake agreements with BHP.

The company started April with about A$4.4 million, boosted by $1.9 million received from the conversion of unlisted options.

It has expanded its core team, recently welcoming experienced Rebecca Moylan as CFO and joint company secretary, and employed more geologists to support its drilling programmes.

It also appointed former CFO and company secretary of nickel sulphide producer Panoramic Resources, Trevor Eton, as a non-executive director.

"His nickel industry knowledge, leadership and experience in all areas of corporate finance, treasury, off-take, risk management, cost control and equity markets, will be a tremendous asset as the company continues to aggressively explore and develop its Saints, Leinster and Nepean nickel projects in Western Australia," Platel said.

Spurred on by the fact all three projects are near existing nickel production infrastructure, Auroch is well on its way towards resource upgrades and its fast-track plans to breathe new life into the historically high-grade Nepean project.

ABOUT THIS COMPANY

Auroch Minerals

REGISTERED OFFICE:

-

Suite 10, 38-40 Colin Street, West Perth, WA 6005

- Phone: +61 8 6383 7817

- Facsimile: +61 8 6245 9853

- Email: info@aurochminerals.com

- Web: https://www.aurochminerals.com/

DIRECTORS:

-

Michael Edwards: executive chairman

-

Robin Cox: technical director

-

Trevor Eton: Non-executive director

SHARES ON ISSUE:

- 428 million

MARKET CAP (at February 8, 2023):

- A$27 million

TOP SHAREHOLDERS:

-

HSBC Custody Nominees (Australia) Ltd 3.54%

-

Getmeoutofhere Pty Ltd, Sinking Ship Super Fund account 2.97%

-

6466 Investments Pty Ltd 1.77%