Aussie companies have poured over $3 billion into North American gold projects over the last 18 months alone.

Just last month Evolution Mining (ASX.EVN) announced it would spend up to A$700 million on the acquisition of the Red Lake Project.

This latest Canadian acquisition takes total investments by Australian resource companies including Newcrest Mining (ASX:NCM), Northern Star (ASX:NST) and St Barbara (ASX:SBM), to close to $4 billion.

Matador Mining (ASX:MZZ) is a $25 million market capped company that was actually ahead of the curve in heading to Canada.

Matador was the first Australian gold developer to enter the Canadian gold market following the acquisition of its Cape Ray project in 2018.

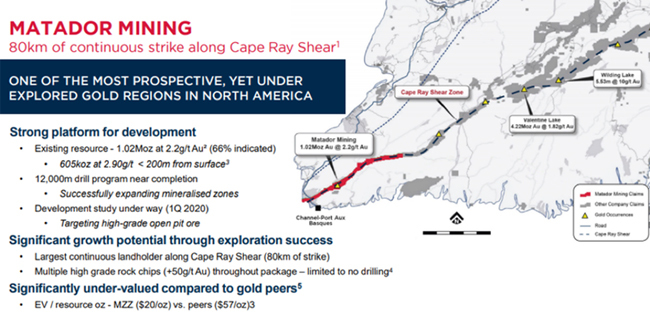

The Cape Ray tenure covers 80 kilometres of continuous strike along the highly prospective, yet largely underexplored Cape Ray Shear in Newfoundland, Canada.

Matador inherited a solid resource, which it has since grown to over 1 million ounces of gold at a very healthy grade of 2.2 grams per tonne gold.

This is a high-grade resource with shallow mineralisation, which means this project has the potential to become one of the highest-grade open pit operations globally in the next few years.

The strength of the project has attracted former Executive Chairman of Regis Resources, Mark Clark and other WA gold mining figures, including Nick Giorgetta, as cornerstone investors in a $5 million Placement.

Clark and Giorgetta have form.

They were behind the sale of Equigold to Lihr Gold for $1.1 billion in 2008. They then took Regis Resource from a microcap company into a $2 billion+ company that paid and declared $325 million of dividends in the last five years.

Clark stood down as chairman last year.

The project itself is developing nicely, with a Scoping Study to be delivered in Q1 2020.

The Study is expected to confirm the Cape Ray project is on track to become one of the highest-grade open pit gold operations in the world.

Global broker, Cannacord Genuity also supports this assumption.

Cannacord initiated coverage in November with a target of $0.70 compared to its current price of just $0.25.

Matador has advanced the project through multiple major development milestones including the largest drill program at the project in more than 30 years.

It also recently updated the market regarding the continued progress of an Environmental Assessment process.

The environmental assessment process for the project made significant progress in the second half of 2019, specifically in the areas of First Nation and Stakeholder Consultation, public participation, regulatory agency consultation, advancement of grid power connection studies and continuation of environmental baseline studies to support the preparation of the Environmental Impact Statement for the project, which will be submitted in September quarter of 2020.

Management is buoyed by the progress with Matador technical director commenting, "Given the current status of the Environmental Assessment, the progress made with the exploration program and our initial assessment work, Matador is on track to potentially become the next major gold producing mine in Newfoundland."

This program has set the company up for major news flow through 2020.