Australia's mining professionals are among the most decarbonisation-sceptical in the world, with many saying the push to net zero emissions is an unachievable distraction, according to new research by Mining Journal Intelligence (MJI).

Nearly all large mining companies have committed to net zero carbon emissions by 2050 or earlier, in line with Paris Agreement targets aimed at limiting global warming. Most have also set interim goals of around a 30% cut by 2030.

But MJI's Global Leadership Survey 2024 reveals significant scepticism within the industry — and the feeling runs particularly deep in Australia/Oceania.

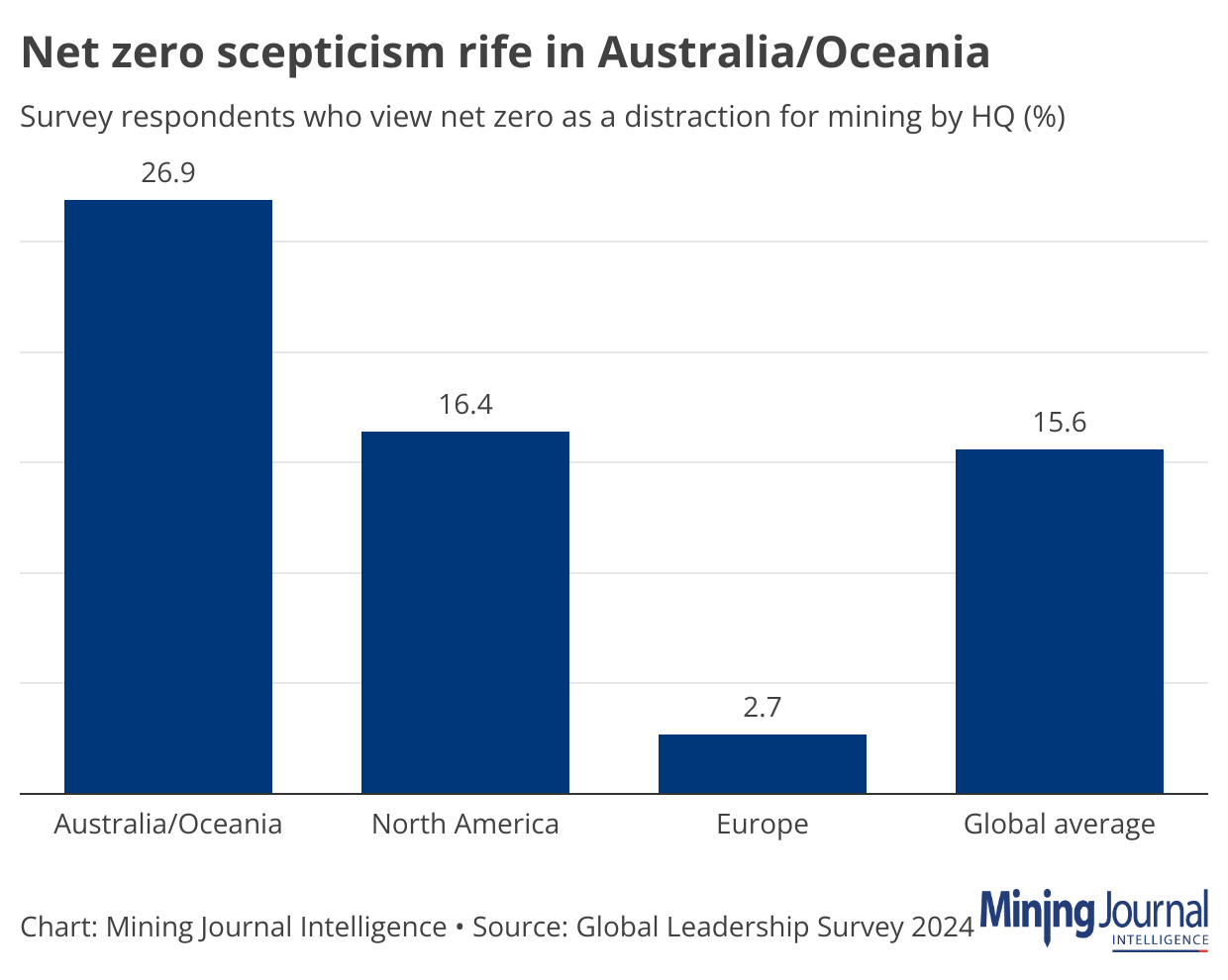

More than a quarter (26.9%) of respondents from the region said net zero was a distraction and that the industry should focus on other priorities — far higher than the 15.6% global average. The figure among North American respondents was 16.4%, and just 2.7% for those based in Europe.

Almost two-thirds (63.6%) of Australia/Oceania-based respondents also said net zero was an unrealistic aim for the industry, although the figure was in line with the global average.

Sceptical perspectives

More than 50 survey respondents left comments in response to the question, with many outlining sceptical points of view about decarbonisation.

"Mining should be pushing back against net zero. It's a pointless, vastly expensive exercise. Ideally, we should be telling politicians to go take a running jump in the lake," an Australia-based technical expert from a small (sub-US$500 million market cap) mining/exploration company said.

But most sceptical comments focused on the practicalities of achieving decarbonisation — rather than questioning its importance.

"In most cases, net zero will drive up costs, which in turn increases cut-off grades thus reducing mineral resources, exactly when net zero demands more metals. This contradiction is unsustainable," according to a director of a mining equipment, technology or services (METS) company in Australia/Oceania.

Questions have arisen about the industry's overall focus on broader ESG (environment, social and governance) issues, with an apparent reduced emphasis on renewable energy and ‘green mining' at this month's Diggers & Dealers Mining Forum in Kalgoorlie prompting Australian law firm Gilbert + Tobin to ask: "Have we already passed peak ESG in metals and mining?"

Glencore has also opted to retain its coal business, despite some pressure from investors. "They [investors] still do recognise that cash is king and that is always the case," CEO Gary Nagle said.

Minority view

However, net zero-sceptics remain a minority, even in Australia/Oceania, according to the Global Leadership Survey. About seven in 10 (69.2%) respondents in the region said mining should be leading the way or doing its part in the push to net zero (the global figure was 79.8%).

"Mining and its products are a key contributor to global emissions. Consequently, the industry should be taking a lead role and demonstrating it is possible to achieve net zero," one manager from an Australia/Oceania-based investment firm said in a comment.

Net zero challenges

The Global Leadership Survey is a key element of MJI's recently published Global Leadership Report 2024: Net zero, which also features insights through interviews with 23 large mining company CEOs and decarbonisation experts.

Participating companies include Freeport-McMoRan, Barrick Gold, Evolution Mining, Pilbara Minerals, and OceanaGold.

The survey was completed by 203 respondents, including 64 from Australia/Oceania-based companies. The global mix of respondents by company type was 47.8% for mining or exploration companies, followed by 43.3% for METS companies, with the remainder investors. Among Australia/Oceania-based respondents, the split was 60.9% mining/exploration companies, 28.1% METS companies and 10.9% investors.

Key themes in the report include the industry's first decarbonisation steps and progress to date, complexities around Scope 3 emissions reporting, top challenges on the road to net zero, and the outlook for 2050.

All companies interviewed have set net zero targets, or plan to do so when their projects are more advanced, with the availability of renewable energy and low-emission vehicles identified as top challenges for progress.

"We currently think that electric drive trucks in the class operated at our site will not be commercially available until after 2030," Pilbara Minerals CEO Dale Henderson told MJI. "This places a significant onus on our power strategy to drive the ‘heavy-lifting' of our decarbonisation efforts in the short to medium term."

Evolution Mining CEO Lawrie Conway added: "The transition to low-carbon mining vehicles is certainly going to be a challenge. For us, the underground fleets will get there before the open pit ones."

The Global Leadership Report 2024: Net zero is available here and can be accessed for free (along with all MJI reports) by Premium subscribers.