The junior miner spent much of 2022 growing the resource at Cactus. A maiden resource at the Parks/Salyer deposit - next door to Cactus - saw the total project resource swell from the 3.5 billion pounds of copper outlined in a July 2021 preliminary economic assessment to more than 6Blb, making it the third most significant independent copper development project in the USA.

Arizona Sonoran CEO, George Ogilvie

Arizona Sonoran plans to incorporate Parks/Salyer into a prefeasibility study for Cactus, which the company will release either in the December quarter of 2023 or the March quarter of 2024.

"We believe that's going to be quite material with respect to the company, and obviously the production profile, and the financial and economics that we produced in the preliminary economic assessment in July 2021. We think those numbers are going to increase substantially," the company's CEO George Ogilvie told Mining Journal.

And Ogilvie, the former CEO of Kirkland Lake, is hopeful that further resource growth could result from the campaigns the company has planned for 2023.

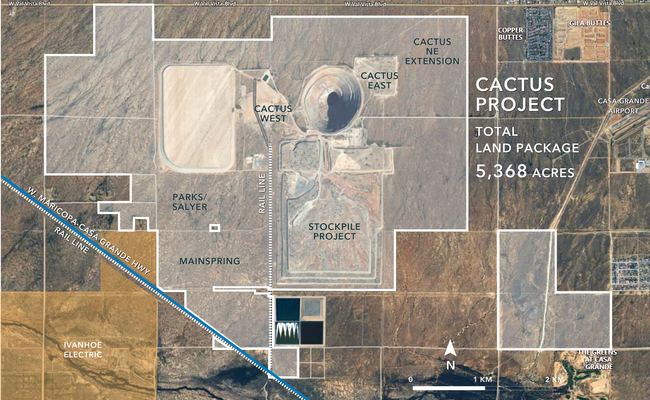

In addition to an infill drilling programme, Arizona Sonoran has two exploration programmes on the agenda, one of which is already underway. The junior is drilling an area known as the Northeast Extension, which lies to the northeast of the main Cactus deposit. It was drilled by Asarco Mining - now part of Grupo Mexico - back in the 1960s, and although they hit decent mineralisation, it was about 1000ft (300m) below surface and therefore of little interest to a company that was focused at the time on open-pittable near-surface deposits.

"It's exactly what happened at Parks/Salyer and today we announced 2.5Blb of leachable copper in the ground, so we're expecting good things from the Northeast Extension with our exploration programme," Ogilvie said.

The second programme, slated for the second half of the year, will focus on an area referred to by the company as the Gap zone, located between Parks/Salyer and the Cactus West pit. This area was also drilled by Asarco but to a depth Ogilvie does not consider sufficient.

"They weren't really exploration holes, they were merely condemnation drilling holes, allowing them to put infrastructure on surface in the 1970s and 1980s, which has now been fully cleared away as the site was reclaimed and cleaned up. And we know that the mineralisation there is probably sitting 1000ft below surface," he said.

Another slightly more leftfield avenue for resource growth has been opened by Rio Tinto. Rio came into Arizona Sonoran as an investor in 2022 looking for an opportunity to deploy its new Nuton Technologies, which aims to leach the primary sulphide chalcopyrite, which accounts for approximately 1.7Blb of the company's current resource of nearly 6.5Blb.

Expectations for the tech, which Rio is developing with other miners including McEwen Mining, Regulus Resources and Excelsior Mining, are high, potentially even transformative for the copper mining sector.

"[The primary sulphides are] not currently part of the PEA that is public nor the PFS that we're currently working upon. So essentially, it's a stranded resource that our shareholders are getting no value for," Ogilvie explained.

Rio is currently conducting column tests using the Nuton tech, and Ogilvie hopes to be able to release results in the June quarter.

PFS-level onsite metallurgical program, 20 ft high columns to mimic bench heights on a leach pad

"If those column tests were to be positive and show that there was the possibility of leaching copper from the primary sulphide, I think that could be a really huge catalyst for the company and could help further drive the share price," the CEO said.

Possibilities arising from Nuton, along with the two main exploration campaigns, have Ogilvie licking his lips. "From a blue-sky potential, I think with the Northeast Extension, the Gap zone and the primary sulphides, there's the ability to take the global resource up by at least another 2-3Blb of copper, which would grow the global resource up to somewhere between 9-10Blb," Ogilvie said. This would put the project on a par with Ivanhoe Electric's Santa Cruz deposit on which the company announced a 10.6Blb copper resource in February, and is located immediately to the south.

Ogilvie has two luxuries afforded to relatively few junior copper mining CEOs: the security of operating in safe jurisdiction, with minimal risk relating to permitting.

Cactus is located on private land, meaning it is not federally regulated - a factor Ogilvie said "completely simplifies" the permitting process. It also boasts an abundance of water, which is permitted for industrial use, and has already secured its aquifer protection permit.

Cactus project map

"The project is significantly permitted. And assuming we can deliver on our timelines for the PFS in the next 12 months, that will feed into a bankable feasibility study to be produced before the end of 2024. The project is then shovel ready. And assuming the project financing is in place, we can be in production at some juncture in 2026, which is a relatively short period of time from today, when compared to a lot of our other peer groups out there," he said.

Cactus also carries a competitive price tag: Ogilvie envisages the capital spend coming in below US$300 million, low compared to other copper mines on a similar scale.

A+ team

Another tick in Arizona Sonora's column is the company's strong leadership team. On the technical side, Ian McMullan (COO) joins from Newmont and Doug Bowden (VP Ex) has explored many major base metal assets within the USA and Mexico. Hydrologist Dan Johnson came in as project manager from Florence Copper in May 2022, having built several heap leach and SW/EW plants in Arizona in the past. The company has also brought in Travis Snider, a permitting guru who acts as VP of sustainability and external relations.

Ogilvie and CFO Nick Nikolakakis, meanwhile, worked together at Battle North Gold, getting the company formerly known as Rubicon Mining back on track and ultimately securing a takeover offer from Evolution Mining. Ogilvie's track record also includes getting the Rambler Metals NL mines operational, after which he joined Kirkland Lake Gold, increasing the share price from $2 - $14/share after improving mine head grade and throughput to the mill.

"We've got a very strong team; as far as operations are concerned, turning companies around, fixing broken stories - of which this isn't one - direct through the technical studies, doing project financings and actually building and constructing them and running profitable commercial mine," Ogilvie said.

ABOUT THIS COMPANY

Arizona Sonoran Copper Company Inc.

Head Office

950 W Elliott Road, Suite 122, Tempe, AZ, 85284 USA

Email: info@arizonasonoran.com

Web: https://arizonasonoran.com/

Tel: +1 520 858 0600

Directors

David Laing

George Ogilvie

Thomas Boehlert

Alan Edwards

Mark Palmer

Sarah Strunk

Market Capitalisation (As of 2nd March 2023):

$205 million

Quoted shares on issue

104 million

Major shareholders

- CI Investments

- George Ogilvie

- Tembo Capital

- Rio Tinto

- AGF Investments

- US Global