The latest economic data coming from China and India is indicating a pick-up in growth in GDP and Industrial Production and the US seems to be doing OK as well. It may be the belated impact of QE from US, Europe and Japan and it just might be that global sentiment is improving and that the influence of the doomsayers is now waning. No Brexit Crash, no October Seasonal Crash and no End of the World so far.

The build-up of cash has continued and the search for income remains, but it is clear that the extreme lows in bond yields have now passed and we are now heading into a very different era that will see many changes.

The evidence from the resources sector is that prices are now rising after almost eight years of decline and will now add to inflationary pressures rather than subtracting from them.

The last Bulls Eye commentary discussed the major new developing trends in the drivers of the flows of capital between sectors but the bond market party is clearly in the very late stages and inflation is picking up. The growing flow of positive data from China and India is reinforcing what the commodity and equity markets have been saying for some time and the price responses are now as expected.

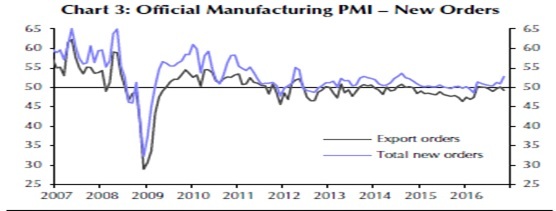

Recent economic data from China shows pick up in PMI figures (below).

Source: Capital Economics

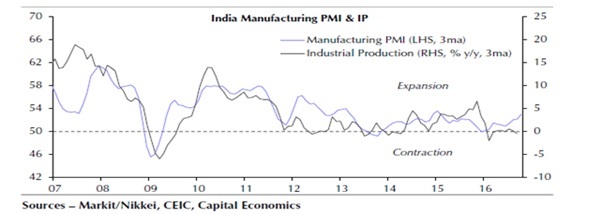

And India, too (below).

These are both showing improving economic conditions.

Note that China takes about 50% of all metals and India is finally beginning to hits its straps with plus-8% GDP growth.

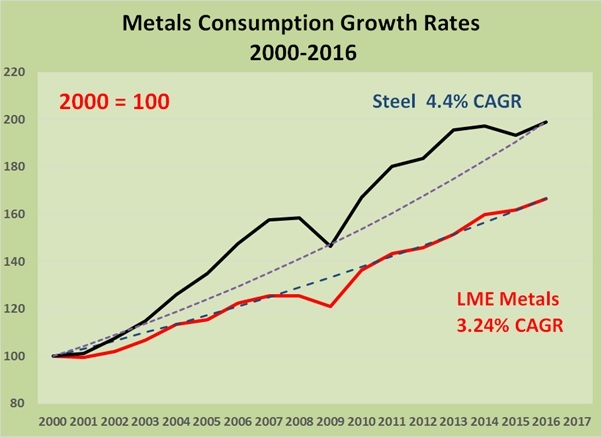

Aggregate figures continue to show consumption is growing in the major metals and the Composite Consumption Index shows LME metals are up 29% since the 2008 lows and steel is 41% higher.

Sources: ILZSG, Copper Study Group, Tin Institute

The average underlying 16-year CAGR for demand for LME industrial metals is 3.24%pa but in more recent times the individual metals are showing very different paths and the underlying trend is still firm.

Some of the growth numbers are quite robust so the increase in net new capacity required is extraordinary. Old mines underperform and even run out of ore so the new additions need to be even higher.

Metals consumption is still at record levels and should accelerate after the last two years of slower growth.

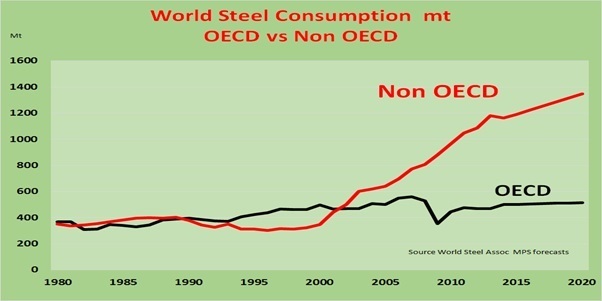

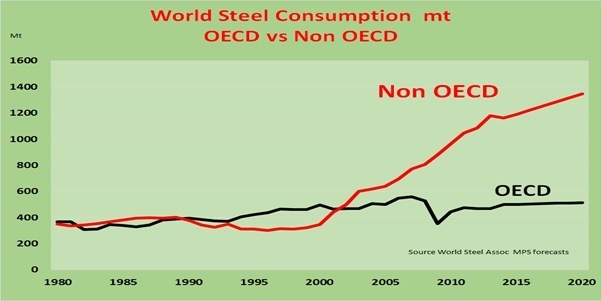

Keep in mind this graphic for steel (below) and think of it as a proxy for all metals. Don’t just focus on US or European activity or consumption data!

The expectations here are that deficits will apply to most metals for the next few years.

To match the consumption growth rates metals mining and processing output will need to be higher. Higher prices will always bring about increased output but new capacity is needing ever-longer lead times so the pressure will be on prices to the upside.

Copper needs another Escondida each year for the next three years. It is the world’s largest copper mine with 1.2 million tonnes per annum contained copper.

How many times have you been underwhelmed by the performance of that new project or disappointed by blue chip Rock of Ages Ltd quarterly production? Gaining that new supply of metal is never easy whilst maintaining existing capacity isn’t either.

The net result is of course that markets will remain tight and any supply interruption will rely on the inventory buffer. The LME inventory buffer is not very large at present so, again, the pricing pressure will be to the upside.

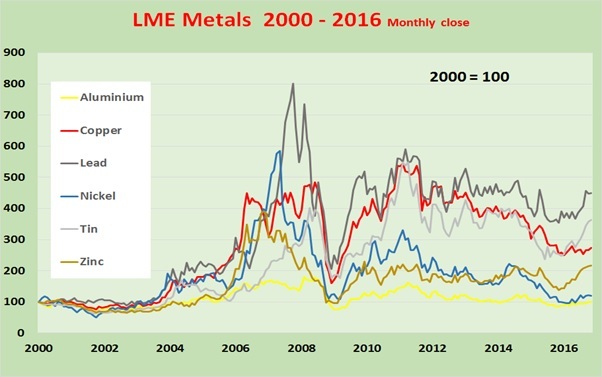

So coming to prices, we have seen a very active 2016 with good improvements for LME prices for aluminium, lead, tin and zinc as they have followed gold and silver but each of these metals has its own supply/demand character that needs to emerge beyond just sentiment.

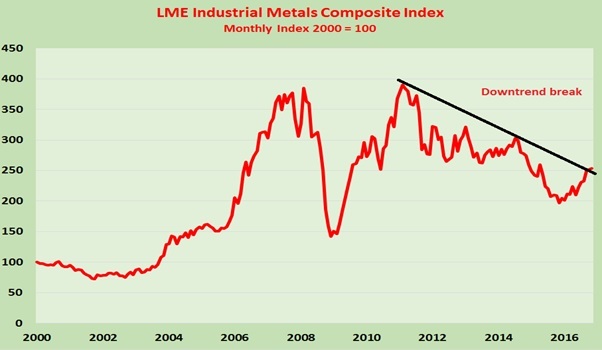

This Composite US$ Price Index (below) of the six major LME metals is in the process of breaking a five-year downtrend and should it do so would provide a very good year for LME metals in 2017.

But the composite is disguising the performance of the individual metals.

With each of these metals it is important to note these points:

|

Metal

|

Commentary

|

|

Aluminium

|

3yr reduction of LME inventories from 5.5Mt to just 2.2Mt

|

|

Copper

|

Supply/demand deficits looming

|

|

Lead

|

Primary mine production <50 % of supply – market firm

|

|

Nickel

|

Unwinding of nickel pig iron issue reducing LME inventories

|

|

Tin

|

Strong price performance in 2016. No LME inventory

|

|

Zinc

|

Strong price performance in 2016. Big supply shortfall in train

|

These all suggest supply problems in 2017 and higher prices.

The shorter term price histories suggest tin and lead have already broken downtrends and are ready to rally strongly over the next few years. Zinc, aluminium and copper are close to breaking out as well and nickel seems to need a little more time but it should be very strong later in 2017.

Iron awe

The resilience of iron ore matches that of steel and reinforces the views expressed here about China and the global economy. Steel over the past decade has been stronger than most of the LME metals and it is doing well.

China is still pumping out steel to local and international markets and the steel mills are making money again at last.

The net effect of stronger consumption demand and also steel mill inventory restocking has been to increase demand for iron ore. And as domestic production in China has declined due to low prices so has import demand risen.

A recent visit to Fortescue’s brilliant 170Mtpa iron ore operations reinforced the positive outlook for iron ore. The demand position is robust, inventories are at low levels at ports and mills and steel mills are profitable again. FMG expects higher iron ore prices into 2017.

And iron ore prices have been rallying. I am still looking at close to US$80/t by year end. Can that be sustained?

The evidence just keeps building up to the Bull’s Eye’s Global Boom that will bring an outstanding period for resources.

Hope you are on board.

*Barry Dawes, BSc FAusImm MSAA, has had more 35 years’ experience in the resources financial markets in key roles as a fund manager, commodities and equities research analyst and corporate financier. He worked at BT Australia, was head of resources research at Deutsche Bank and also at Macquarie Bank prior to setting up and running Martin Place Securities for almost 17 years. He is currently executive chairman and head of resources.